Content

- What is the Cost Method of Accounting for Investments?

- Updated IASB work plan — Analysis (January

- Evaluating Indicators of Significant Influence

- Using the Cost Method for Investments

- SEC Registrant Considerations Related to Equity Method Investments

- Differences Between Cost Method & Equity Method

- Equity Method of Accounting Definition & Example

The shareholders make gain from such holdings in the form of returns or increase in stock value. All these instruments are also tested for impairment when there are either external or internal indicators of impairment and written down to recoverable value in the balance sheet. The impairment allowance is recognized in the income statement immediately. In investment accounting, the cost method is used when the investor holds less than 20% in the company, and the investment has no significant fair value determination. The equity method is meant for investing firms that hold a great deal of power over the other company while owning a minority stake, as is often the case for firms with between 20% and 50% of ownership, but not more than 50%.

What is the difference between the cost method vs. the equity method?

The main difference between the cost and equity methods is that it applies to investors with less than 20% shares in a company. The equity method applies to investors with between 20% and 50% of the company’s shares.

This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Loans should be periodically evaluated for impairment subsequent to initial recognition and measurement.

What is the Cost Method of Accounting for Investments?

Then combined periodically and reported in consolidated financial statements. In such a case, investments made by the parent company are accounted for using the consolidation method. The investor may also periodically test for impairment of the investment. This affects both net income and the investment balance on the balance sheet. At the end of the year, ABC Company records a debit in the amount https://online-accounting.net/ of $12,500 (25% of XYZ’s $50,000 net income) to “Investment in XYZ Corp”, and a credit in the same amount to Investment Revenue. The equity method is used to value a company’s investment in another company when it holds significant influence over the company it is investing in. In the cost method, you never increase the book value of the shares because of an increase in fair market value.

See ARM 5010 for further information on accounting for cost method investments. Typically, single power plant entities are private entities with a limited number of owners, and equity shares are not traded on an exchange or over-the-counter market. As a result, Accounting for Investments: Cost or Equity Method although the reporting entity should consider the facts in each situation, common equity interests in these entities are typically not accounted for under ASC 320. Accounting methods are typically used to record the value of the assets in a company.

Updated IASB work plan — Analysis (January

It is based on the accounting equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the company. Therefore, if Macy’s bought 10 million shares of Saks stock at $5 per share for a total cost of $50 million, it would record any earnings it received from Saks on its income statement. On its balance sheet, Macy’s would record $50 million under investments. For example, when the investee company reports a net loss, the investor company records its share of the loss as “loss on investment” on the income statement, which also decreases the carrying value of the investment on the balance sheet. Using the equity method, a company reports the carrying value of its investment independent of any fair value change in the market. Under the equity method, the investment is initially recorded at historical cost, and adjustments are made to the value based on the investor’s percentage ownership in net income, loss, and dividend payouts. GAAP and IFRS require that companies apply the equity method of accounting to report for minority active investments (i.e. less than 50% ownership, but significant investor influence over investee).

- The ownership of a corporate joint venture seldom changes, and its stock is usually not traded publicly.

- The equity method is applied when the investor has the ability to apply significant influences to the operating and financing decisions of the investee.

- Based on its analysis, the Committee concluded that a reasonable reading of the requirements in IFRS Standards could result in the application of either one of the two approaches outlined in this agenda decision .

- Compute the amount of income to be recognized under the equity method and make the journal entry for its recording.

- Elects to account for its investments in subsidiaries at cost applying paragraph 10 of IAS 27.

- This is because the price of an investment is not adjusted for inflation, as the cost method assumes that the cost will remain the same over time.

- In such a case, investments made by the parent company in the subsidiary are accounted for using the consolidation method.

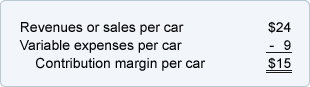

The equity method of accounting should generally be used when an investment results in a 20% to 50% stake in another company, unless it can be clearly shown that the investment doesn’t result in a significant amount of influence or control. For example, if your company buys a 5% stake in another company for $1 million, that is how the shares are valued on your balance sheet — regardless of their current price. If your investment pays $10,000 in quarterly dividends, that amount is added to your company’s income.

Evaluating Indicators of Significant Influence

Preparers and other users of this guide are encouraged to monitor the status of the project and, if finalized, consider the implications on accounting conclusions. The first consideration is whether the entity should be consolidated under the variable interest entity consolidation model. There is a unique consideration for partnerships in applying this model when determining if the equity holders as a group have the power to direct the activities that most significantly impact the entity’s economic performance. Any limited partners would have to hold substantive kick-out or participating rights to demonstrate that power.

- This guidance is not applicable if the investment is in a limited partnership or limited liability company that functions like a partnership.

- It is considerably easier to account for investments under the cost method than the equity method, given that the cost method only requires initial recordation and a periodic examination for impairment.

- This content outlines initial considerations meriting further consultation with life sciences organizations, healthcare organizations, clinicians, and legal advisors to explore feasibility and risks.

- Because the equity method is applied, the reader knows that this figure is the investor’s ownership percentage of the income reported by the investee.